We'll stroll you with this intricate monetary product and also assess its pros and other words for hectic cons by addressing one of the most typical concerns people have regarding reverse home mortgages. As a case in factor, when I got a reverse home loan in 2017, I was educated that I was required to put up a cash money set-aside as a result of a government (U.S) tax lien. As I, sadly, did not have enough funds for the set-aside, nonetheless, the application was decreased, and I have consequently been living below the poverty line and battling for survival since. With fixed-income properties paying next to nothing nowadays, reverse mortgages might be a beneficial means to money daily living expenses. If you prepare to leave your home to successors, they'll require to recognize their payment choices.

.jpg)

- Since the car loan earnings can be invested as the customer chooses, a reverse home loan can provide monetary flexibility as well as liberty throughout retirement.

- On the various other hand, the money you get from a reverse home mortgage is not taxable.

- Therefore, HUD does have minimal requirements the residential or commercial property have to satisfy to be eligible for the program.

- Instead of paying the lending institution back each month, you settle the lending institution when you no more stay in the home.

- A reverse home loan provides you accessibility to funds without sending you a prompt bill.

- Determining in between kinds of home mortgages can really feel overwhelming.

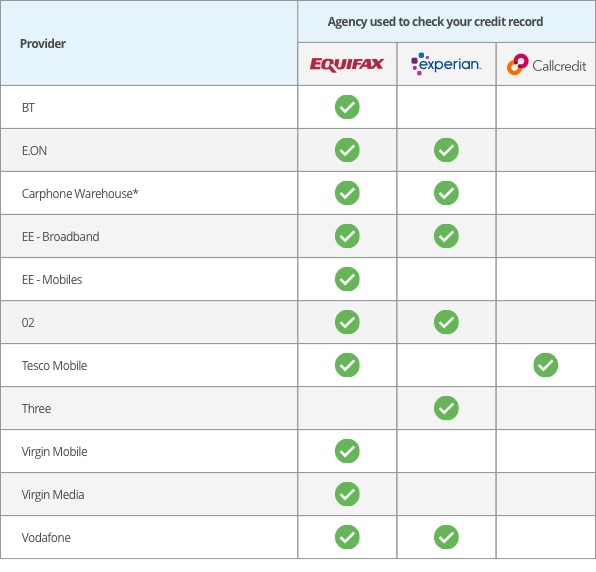

Founded in 1976, Bankrate has a lengthy track record helpful people make smart economic choices. We have actually kept this track record for over 4 years by demystifying the monetary decision-making process as well as providing people confidence in which actions to take following. An excellent approach might be taking a few of the first cash and also putting it right into modifications to make the house adaptable for someone as they age. Yet there are disadvantages, such as intricacy of the finances as well as their substantial expense. To send a conflict online go to Experian's Dispute Facility.

California Reverse Mortgage Regulations

According to AARP, about fifty percent of individuals applying for reverse home loans in today's market are under the age of 70. If you're planning to relocate-- Remember that you need a lengthy path to make paying all the closing costs, home loan insurance coverage costs and various other charges worth it. So, if you believe you may intend to move to a new location or downsize to a smaller location anytime quickly, stay away from a reverse mortgage. The bigger your financing equilibrium on a reverse mortgage, the much less equity you have in the home. So, you'll lose some of the equity you've developed over the years with a reverse home mortgage.

Vehicle Insurance

That will certainly go down to 58%, according to the Wall Road Journal. That suggests you or your survivors will never owe greater than what the home is worth. If that's not worth enough maintenance cost calculator to cover the balance of your funding, home mortgage insurance coverage pays the difference. In 2015, the CFPB fined AAG $400,000 after it determined old ads including Fred Thompson wrongfully claimed customers couldn't shed their residences. Lots of others wound up losing cash with a reverse home mortgage.

Can You Obtain Versus An Adverse Residence Equity?

As a result of start-up fees and higher interest rates, reverse mortgages are extra costly than conventional lines of credit or home loans. Very early payment of all or a section of the quantity borrowed might subject you to prepayment penalties. Loaning versus your home will certainly impact the quantity available to pass on to your recipients. Many https://apnews.com/Globe%20Newswire/36db734f7e481156db907555647cfd24 elders experience a considerable revenue reduction when they retire, as well as monthly home mortgage settlements can be their most significant cost.

If you have a question, others likely have the very same inquiry, too. By sharing your concerns as well as our answers, we can aid others too. We believe by offering tools and education and learning we can help individuals enhance their financial resources to reclaim control of their future. While our write-ups may consist of or feature choose business, vendors, and also items, our approach to putting together such is equitable as well as objective.

Join our mailing list to obtain the most up to date in lifestyle material, economic recommendations, information and details from Professor Craig to live a better retirement. Ramsey Solutions has actually been devoted to assisting individuals regain control of their money, construct riches, grow their leadership skills, as well as enhance their lives through personal development because 1992. Millions of individuals have actually utilized our monetary advice with 22 books published by Ramsey Press, along with two syndicated radio shows and also 10 podcasts, which have over 17 million once a week audiences.

The car loan balance, consisting of interest, might leave them little to absolutely nothing to inherit from this specific property. As we have explained, a reverse home mortgage is wrong for everybody, yet like any kind of various other lending it is a feasible alternative to help people secure the funds they may require to meet their retired life objectives. Customers that secure traditional financing requirements pay that regular monthly payment every month or they take the chance of credit score troubles or possible repossession. And afterwards after a normal forward home mortgage, you wind up paying a big chunk of your home's value in rate of interest over that time anyway. The difference is that you paid it in monthly settlements so it wasn't one large repayment at the end.